Within the past month there have been 2 more “green” energy failures that will cost the the U.S. taxpayers over $260 million. The most recent losers are:

Ener1, a company that makes rechargeable batteries for electric cars filed for Chapter 11 bankruptcy today. The company was the recipient of a $118 million Department of Energy Grant.

“Jan. 26 (Bloomberg) — Ener1 Inc., which received a $118 million U.S. Energy Department grant to make electric-car batteries, filed for bankruptcy protection today after defaulting on bond debt amid heavy competition from Asia.

The company listed as much as $100 million each in assets and debts in papers filed in New York. Among the company’s largest unsecured creditors were Liberty Harbor Special Investments of New York, holders of $39.4 million in senior notes; Itochu Corp. of Tokyo, holders of $10.2 million in senior convertible notes; and Goldman Sachs Palmetto State Credit Union of Florida, holders of $5.63 million in senior notes.

The company has been affected by competing battery developers in China and Korea, “which generally have a lower cost manufacturing base” and lower labor and raw material costs, interim Chief Executive Officer Alex Sorokin said in the petition.

The company makes lithium-ion batteries for plug-in electric cars, which are being scrutinized by federal auto- safety officials after a General Motors Co. Chevrolet Volt caught fire, people familiar with the probe said in November.”

Read the whole article here

Range Fuels was a company that was supposedly going to turn wood chips in to bio-fuels. Range was the recipient of over $162 million in federal grants and loan guarantees.

“It seemed like a great idea — turn the waste from Georgia’s abundant forestry industry into biofuel and provide much-needed jobs in one of the state’s poorest rural counties while helping free the country from dependence on foreign oil.

When Range Fuels Inc., a start-up based in Broomfield, Colo., announced in 2007 it would do just that, everyone — from locals to Silicon Valley venture capitalists, from then-Gov. Sonny Perdue to then-U.S. Secretary of Energy Samuel W. Bodman — was excited and on board.

The new plant, touted as a major alternative energy coup for Georgia, would be the nation’s first facility to turn scrap wood from the harvesting of pine trees into cellulosic ethanol fuel.

Five years and more than $300 million in investments later, the plant that had been expected to produce as much as 20 million gallons of fuel a year as early as 2009 was sold in foreclosure for a mere $5.1 million.

Neither the 20 million gallons of ethanol nor any of the 70 promised jobs ever materialized, leaving taxpayers holding the bag for millions in grants and unpaid loans.

While published amounts vary, the Atlanta Journal-Constitution reports the failed Range plant cost U.S. taxpayers $64 million and Georgia taxpayers another $6.2 million. Authorities say the $5.1 million from the sale earlier this month to Lanza Tech, a New Zealand-based biofuel company, will help offset loan losses suffered by the U.S. Department of Agriculture.

So what happened to burst this promising biomass bubble?”

Read the whole article here:

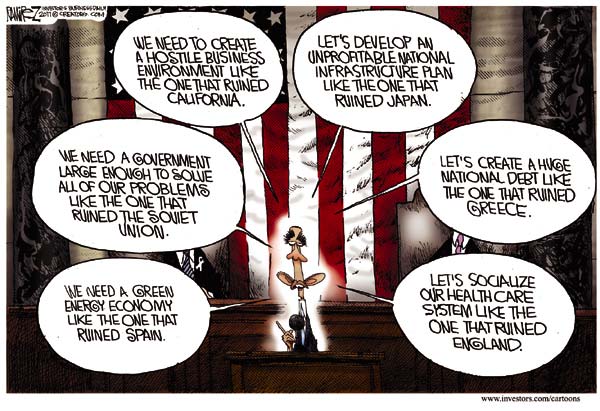

However, you’ll be relieved to know that Rep. Jan Scharkowsky (D-umbass) says that the 20,000 jobs that would have been created by the Keystone XL Pipleline Project are no great shakes as “green” jobs are the way of the future.

“Twenty thousand jobs is really not that many jobs and investing in green technologies will produce that and more. But I’ll tell you what, you know it seems to me that the Republicans would rather have an issue than a pipeline.”

Read the whole goofy thing here